Tenaz Energy: Out of Control

Tenaz has gotten themselves into an interesting situation, I believe — the factors that would see the business increasing in value, at this point, are entirely out of management’s control. While shareholders may believe they are investing in an experienced leadership team with the mandate of creating value (and that is not refutable, their CEO has almost 2 decades under his belt leading Canadian public E&Ps) — there are really three factors, ex-M&A, that will drive significant value for Tenaz equity holders, ceteris paribus — the success of CC(U)S and the willingness of European governments to subsidize associated capital spending, the price of European natural gas, and technological developments that lower the cost of abandoning offshore platforms. Now, part of Tenaz’ pitch is their willingness to consider value-add M&A, but I still remain skeptical there is significant alpha to an international asset roll up strategy.

Two of those three are far into the modelling window that they may not be impactful to short term cashflows, and the price of European Gas is not controllable by Tenaz management. The whipsawing back and forth of European Gas prices this week only works to prove my point. When I started writing this, TTF was €25/MWh, trading as low around ~€20/MWh — today it traded within spitting distance of €50/MWh, a 100% gain over my first ink. Between then, in just a few days, Tenaz has went from likely very unstable through EOY, to having some breathing room. Incredible — as it stands, the price of European Gas is in the drivers seat here.

Those same three factors will be working against them, and may cause Tenaz to struggle over the coming year. Along with continued underperformance of their Canadian asset there are a myriad of other short term negative hurdles that Tenaz may have to face — including, no free cashflow over the next ~24 months (cumulative, on strip), eroding at their ability to sell themselves as a successful consolidator.

But I think there’s an opportunity for the team to pull off something crazy. It would really totally change what is, in my opinion, quite a glum trajectory.

The bull case for Tenaz is fairly simple — they are going to purchase international assets that are perhaps undervalued, and deliver free cashflow to shareholders. They have a management team that is experienced, and while all of this sounds great on paper, reality is that international roll-ups (not explorers) are usually met with non-operated positions, end of life assets, structurally lower multiples (see, also: higher costs of capital), and assets in tough to manage jurisdictions.

There’s certainly enough content on the internet that rehashes the bull case for this company, including on Tenaz’ own YouTube page — that I don’t feel the particular need to revisit the bull case in depth, rather, I took to engaging management to answer the questions that I believe are important to be answered along with the widely advertised bull case — to really give a well rounded view of their story.

So we are going to do this post in a bit of a different manner — a Q&A with management, that covers the questions that any Tenaz investor should know the answer to, then I will provide some additional colour, both positive and/or negative. Following that — a discussion in my normal style.

I again, thank Tenaz management for their engagement with me; their confidence in their operations is immense, and they are clearly knowledgeable folks. Their willingness to speak with me, someone that has been overtly negative towards their operation, speaks volumes to their credence and conviction in their story, and something that I respect immensely.

Does Tenaz include the abandonment capital spending required for the Dutch offshore assets (disclosed as $11.5m between 2023 and 2024 in Tenaz’ YE22 AIF dated 21/03/23) in your guided $20-24m of E&D capital spending for 2023?

No, as is industry standard, exploration and development (E&D) capital spending is disclosed as capital spent on exploration and development — in Tenaz’ case, this is primarily developing their Leduc Woodbend asset, and their Dutch North Sea (DNS) asset. This does not include decommissioning capex which would be additional to the guided figure.

In terms of tax liability acquired from the QSub is that full amount due from Tenaz, or is there an additional closing adjustment paid by the seller. When are those taxes due, and is the full liability listed on Tenaz’ balance sheet explicitly borne by Tenaz?

The CFO stated the current tax liability is borne entirely by Tenaz, and that the current tax liability (due within 12 months) is more than offset by current assets.

Does a possible sale of Neptune (the operator of the Dutch assets) worry you?

Tenaz had stated that it gives them something to think about, though it does not worry them, as it would be unlikely that a new operator would be interested in accelerating the abandonment schedule, and unlikely that a new operator would materially impact (to the downside) the present value of their stake. They had also stated that perhaps a new operator would allow them the opportunity to consolidate their position, even perhaps assume operatorship.

What is the structure and/or sampling methodology for determining the surety cash amounts needed to secure ARO, can you replace that with a surety bond?

For surety cash, the sample is two years backwards, and one year forward for the price used to calculate the estimated cashflow. They also noted they are very optimistic that the surety cash deposit will continue to trend down in the future, and that the calculation is made asset by asset, not on aggregate. They are currently working on replacing the cash they have on deposit, with a surety bond, and that any A- security is acceptable — and noted the reason that they opted for cash to close was due to the timing of their transaction (over the holidays).

Has carbon capture, and storage (CCS) been explored to date, what does that look like returns wise, capital wise, and how do you see Tenaz’ participation?

While CCS is in “early days”, Tenaz is under no obligation to participate in any projects if they don’t meet their hurdle rate. They are unsure of what it would look like, functionally, but they would be able to store a lot of carbon net to them.

Would youguys consider selling the Canadian assets if the opportunity arose?

They are not actively seeking to dispose of their Canadian assets, while they acknowledge it’s not a company making asset, they think that Altura (the previous operator) has discovered a good pool.

Is Tenaz’ able to drop the Luxembourg based SubCo in a scenario where the cost to carry the ARO becomes unproductive?

Tenaz elected not to comment on the various possibilities they would see in a subsidiary liquidation or bankruptcy situation.

How do youguys see abandonment costs evolving — does Tenaz have input and ability to implement new technologies (through collaboration with the operator), and what is the split between subsea tieback and platforms? Does the spider drilling style and number of sidetracks/complications concern Tenaz re: the number being understated?

Tenaz works closely with the asset operator to bring costs down, and think that they are currently overstated. They believe that the reserve evaluator numbers are safe/generous, and think that the abandonment costs will come down over time. 3-4 of their total Dutch well count are subsea tiebacks.

In the future, are youguys open to hedging, what is the price range for that?

Because Tenaz doesn’t currently have a dividend, or any capital return commitments, management said they would likely continue to keep most of their production unhedged, but are open to the idea of hedging production.

What is the acquisition structure/type of asset youguys are looking for next — both in terms of reserve profile (PDP heavy, or more development needed), and in terms of capital structure (would favour debt due to high level of restricted cash on the balance sheet, or try to tap the equity markets)?

Tenaz is looking for assets that they are able to add value to, and high free cashflow assets — they have seen opportunities that fit that bill in Europe, the Middle East, and North Africa, and their broad skillset of board, and management members, affords them the ability to cast a wide net. Financing wise, they will evaluate asset-by-asset as to the capital structure of an individual deal, though would tend to favour free cashflow producing properties that can support debt.

Do you see Tenaz as uniquely able to provide high spread between ROIC and WACC when it comes to your seeking of international assets — do you believe that your cost of capital will be higher given your size and your breadth, how does this change your acquisition strategy?

Management had stated that they believe they will not be disadvantaged over the industry with respect to cost of capital, and believe that if they can seek out better valuations on entry, and better returns on entry, with a position to improve the asset, they will be able to grow the company, and market cap over time — and over the long term, better prices, and asset improvements, the market will recognize the Tenaz value proposition through a better multiple.

So now, we get to the part where I go through and provide some additional background behind the questions I asked, and why I asked those questions. In many cases, they were meant to highlight some sort of deficiency I had identified within the business, so below I will explain why I think any shortcomings exist.

Does Tenaz include the abandonment capital spending required for the Dutch offshore assets (disclosed as $11.5m between 2023 and 2024 in Tenaz’ YE22 AIF dated 21/03/23) in your guided $20-24m of E&D capital spending for 2023?

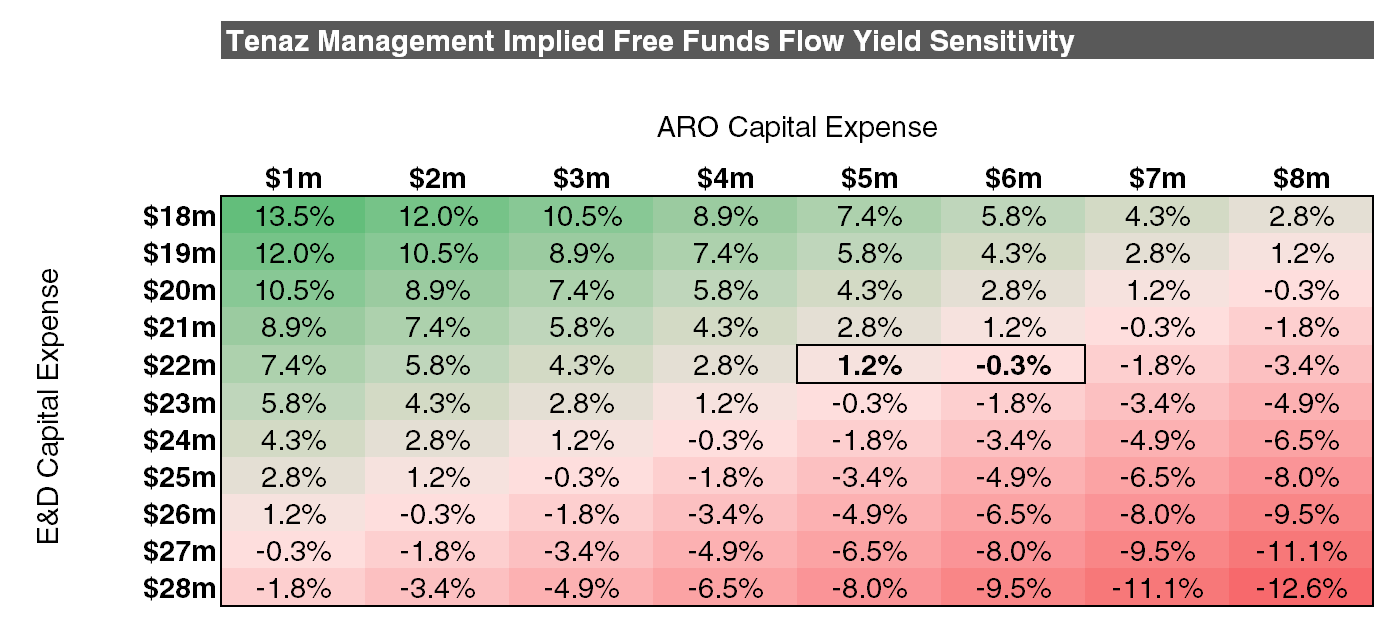

While the choice to not include decommissioning capital in the investor slide deck is certainly not incorrect — as they do explicitly state “E&D capital expenditures” — the way the DNS acquisition was structured, is they are essentially capitalizing the entire thing through ARO capex (as ARO capex reduces the decommissioning liabilities which aren’t shown in net debt, or in share capital), and the exclusion of ARO capex is at the very least confusing to potential shareholders. ARO capex does indeed reduce free cashflow, and Tenaz’ own corporate guidance for FFO is ~$28m (bear in mind, with a €50/MWh TTF assumption) so taking the guidance midpoint would have them at $6m of free cashflow, or a 9.5% yield to market cap (before ARO, on a higher than strip TTF assumption) — with ARO factored in, for every $1m they spend on ARO (with the implied midpoint for this year ~$5m), their FCF yield falls ~1.5% — and there is a situation, with full E&D capex, and full ARO capex, that they have a -3% FCF yield. Below is a table that shows implied yield at different levels of E&D (advertised) and ARO (less advertised) capital spending. Remember this is still with a generous TTF gas assumption. On 06/13 strip, there is a scenario where they are -5% FCF yield. It’s not a pretty situation.

(Note: the table above is taking company guidance for FFO and subtracting implied E&D capex, then implied ARO capex, without any further info/adjustments)

In terms of tax liability acquired from the QSub is that full amount due from Tenaz, or is there an additional closing adjustment paid by the seller. When are those taxes due, and is the full liability listed on Tenaz’ balance sheet explicitly borne by Tenaz?

The entire current tax liability is to be borne by Tenaz. This means that the $22m current tax liability they have on their balance sheet is to be paid entirely by Tenaz within the next 12 months. So — if you net that out of working capital, really, Tenaz’ entire working capital balance is $17m of restricted cash — which, ask any other resource operator (say, Peabody Coal) — it is absolutely not working capital. So — really, this is a business with little to no free cashflow — that huge “negative net debt/net cash” number that the company and promoters tend to cycle, is really just restricted cash (i.e. the Dutch government’s estimate of the asset’s negative free cashflow) and for the next 24 months, I would be weary to say that Tenaz generates any free cashflow at all.

Does a possible sale of Neptune (the operator of the Dutch assets) worry you?

I think this is the most cutting and interesting question, with the strongest implication for what Tenaz looks like in 6-8 months.

So Neptune, the operator of the Dutch assets, is looking to sell, they were in talks to sell to Eni (Italian supermajor) earlier in the year, but they didn’t go anywhere. Then, as of last week, Eni and Neptune are back at the table.

The issue for Neptune, is the Netherlands assets are a huge drag on their portfolio. At 2021 they were a net liability of $378m, and a net liability of $184m at 2022 year end (thanks to higher prices, prices are now, back to 2021 levels) — this is not ideal for Neptune, and especially not ideal for a company like Eni, who is committed to the whole ESG thing.

Neptune has already been in talks to sell their German assets (the other business segment with a negative net asset value), so getting rid of their assets in the Netherlands (a huge drag on the business) would almost certainly make the sales process infinitely easier. Keep in mind, Neptune was a company built to be sold.

So, how could Tenaz make this work, after all, that is a huge deal to work out.

In walks the Vendor Take-Back loan (VTB). We’ve seen in 2022, a number of companies that could perhaps not secure financing through other means (i.e. Journey and Surge) engage in VTB financing with selling parties that are looking to exit an area, and quickly (namely, Enerplus leaving Canada).

For Tenaz to assume full operatorship, they’d have to post a huge decommissioning bond with the Dutch government, but Tenaz would walk away with 18,500boe/d.

If Neptune is to provide a VTB loan in the amount that is, the cash Tenaz would have to post with the government (or a surety bond provider), they would be able to effectively remove the asset (read: technical liability) from their books. It would be an amazing deal for Neptune — they would effectively replace $300m of decommissioning liability on their balance sheet, with a VTB loan (an asset) to Tenaz. Tenaz’ consideration would be the assumption of the decommissioning liability.

Tenaz pro forma balance sheet would look like this — new assets include the PP&E associated with Neptune’s DNS assets, and restricted cash in the amount required to post with the Dutch government. They’d offset the restricted cash with a VTB loan (liability), and offset the PP&E with a decommissioning liability — but it wouldn’t cost them anything, other than a small debt (or equity, probably equity) raise for working capital attributable to their spankin’ new asset.

It’s genius really. Tenaz' cash outlay is nothing, they get to almost 10x production, and it doesn’t cost them a thing. Neptune on the other hand, they are laughing, assuming the VTB loan is pretty sweetheart to Tenaz — their intangible cost is the spread between interest and possible return on the VTB loan amount (I’d assume it’d be around $300m in size) — but they take something that was worth -$184m, and turn it into a VTB asset. Tenaz gets to grow production, increase leverage to TTF prices, and most importantly, do it without a debt or equity raise.

It would get them a crazy story to sell. The Dutch government is already interested in extending field life, and there is a great CCS opportunity. Though, I’ll discuss this more at the end of this post.

Note: with this wild move in TTF prices (I wrote this part of the post on June 12th) I think it’s more likely that the Dutch regulator is willing to let something like this through, and I would have to think that Neptune would still be motivated to sell)

The rest of this equity research piece is for paid subscribers, please take advantage of the offer below should you be interested in subscribing to my work.