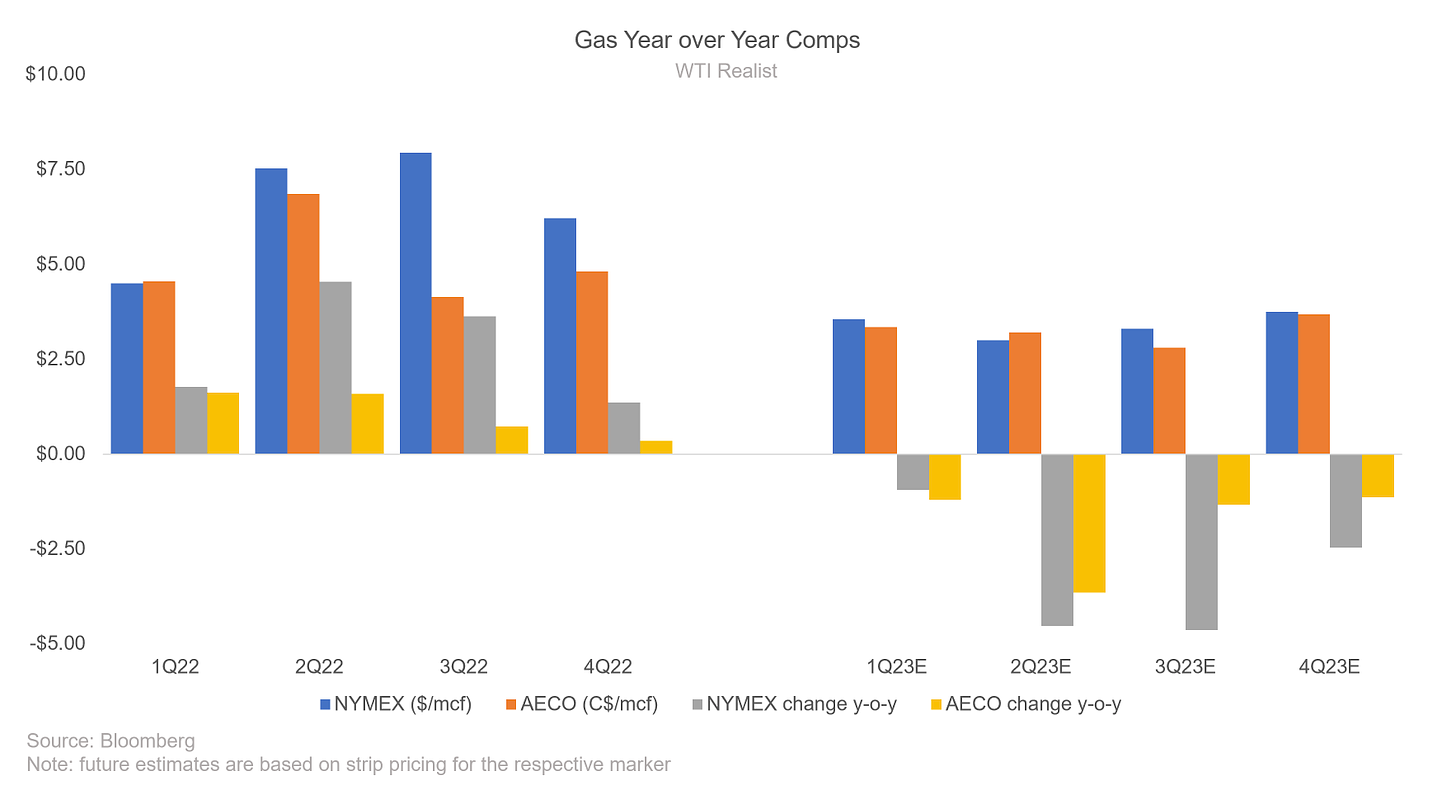

I had originally started with my 4Q22 lookback, and 2023 lookahead on here with the intention of publishing one big note. But quick thoughts turned into pages on each name, which turned, originally, a brief thinking on a few dozen names into an hour-long read. So instead, I will release these in piecemeal over the coming weeks into the long awaited energy earnings prints. The first — Peyto Exploration & Development Corp. (TSX:PEY). 2023 is going to be a headwind for gas producers — this isn’t quite a secret, and while Peyto has the chops to weather any storm, they screen poorly compared to peers going into 2024, both with respect to dividend sustainability, and debt levels. I wouldn’t expect either capital expenditure or the dividend to slow with a new CEO, it would be a “bad look” to start a tenure that way.

To The Upside

Expect Peyto’s bottom-line “profit and earnings” focused approach to shine through with the next half-dozen earnings prints. While gas strip has trended lower (much lower) they have continued to take a “business first” approach to being an E&P, rather than an “upside first” approach (see their 10yr return on equity later). These “business first” E&Ps are the ones you generally want to own when you’re done levering beta on the upswing. Most E&Ps would rather keep the commodity price upside while leaving their downside unprotected— on the contrary, at times in their history Peyto has hedged 85%+ of their production, to keep product realizations such that their return on capital is competitive with other non-cyclical sectors. This year would be no different. While a warm winter and steadily increasing basin supply have quickly turned the outlook for North American gas sour, Peyto steps into 2023 with 50% of their volumes hedged.